I have been dealing with major medical expenses related to oligodendroglioma for 13 years. One thing I have learned is to never expect your insurance carrier to do the right thing. But the latest example of this truism is really mind-blowing, and it can definitely affect many rare cancer patients in California and possibly around the country.

My younger son was on a “silver” PPO plan with Blue Shield that he bought through Covered California, the health insurance exchange. Over the years, my family has sought treatment and second opinions across the country. This is not an exotic or unusual thing to do since treatment options—and especially clinical trials—are often available in a limited number of locations. For example, 7 years ago when my son was facing the need for radiation, we selected MD Anderson in Houston since they were one of the few places offering proton therapy at the time. (Proton exposes less healthy brain to radiation, thereby reducing the risks of cognitive damage.) While our insurance company initially denied coverage (proton can be much more costly than traditional radiation, so insurers don’t want to pay for it), we ultimately got it approved. (See this video about proton therapy denials and overcoming them).

This February, we went to Mayo Clinic in MN to have another course of proton radiation (the head of the proton program at MD Anderson had moved to Mayo 5 years earlier). We were ready to board a plane on Tuesday to begin treatments on Wednesday, when we got a call that Blue Shield had denied coverage. We were shocked since proton and photon radiation cost the same at Mayo, so cost was not a problem. Fortunately, the team at Mayo was amazing and found a way for us to move forward with the treatment plan on schedule!!

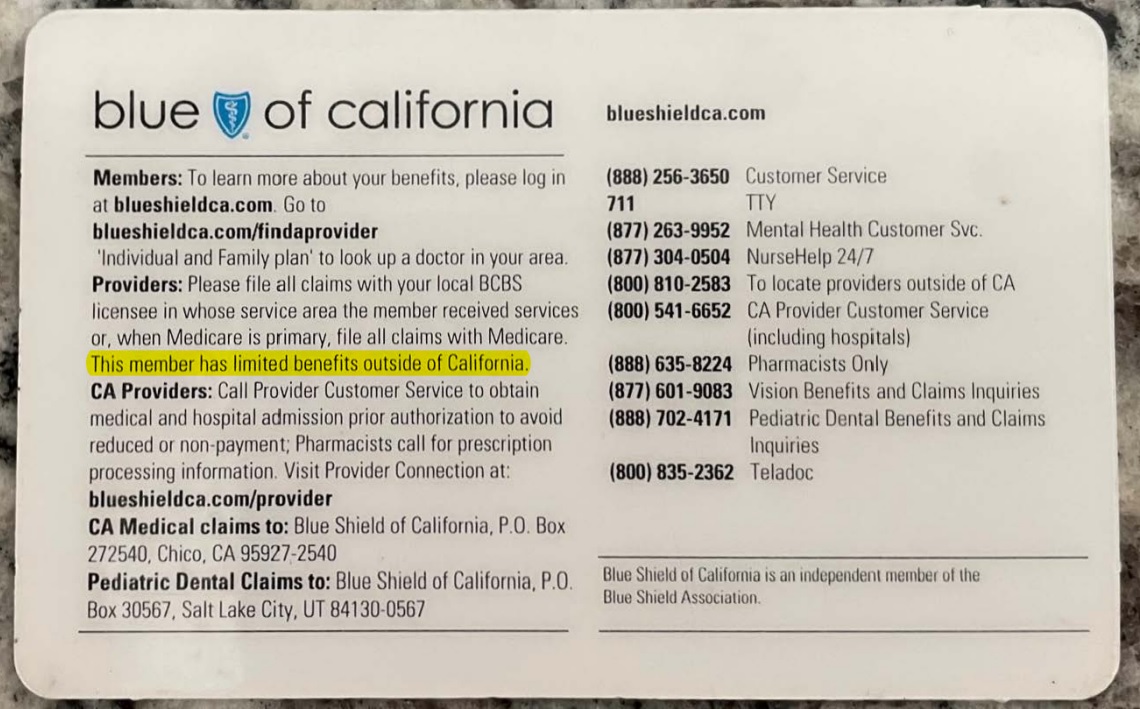

After a little investigating, we found out that Blue Shield plans offered to individuals through Covered California only cover medical expenses—other than emergency services—in California! This is as nonsensical as it is outrageous. But what makes it feel criminal is that this limitation is not disclosed on the Covered California website or on the 15-page “Summary of Benefits” provided by Blue Shield. A major limitation of coverage like this should be at the top of page 1 in bold letters. But it doesn’t show up anywhere in the 15-page benefit summary.

Further investigation revealed that Blue Shield PPO plans on Covered California offered through small businesses do offer normal coverage outside CA. 100% WTF. Why would the plans offered to individuals directly be so different than the plans offered through small employers?

Why This Matters

So, is the fact that Covered California/Blue Shield offers such limited coverage to individuals outside the state a big deal? Yes, it is when you have a rare disease. Most rare diseases have a handful of medical institutions that offer real expertise in the disease, so getting the best care often means going out of state. Furthermore, clinical trials always start at a very small number of hospitals and the chances that they will be in your state are small. In our case, there was no leading brain cancer center in CA that offered proton radiation therapy. In addition, my son had also been on a waiting list for a clinical trial at MD Anderson and his number came up. But, due to the fact that his normal insurance coverage stopped at the state line, my son didn’t get a spot in this trial.

So bottom line, my son’s insurance was going to prevent him from getting potentially life-saving treatments—after not disclosing that their coverage did not include non-emergency treatment outside of CA. This is wrong on so many levels, but not all that shocking for insurance carriers.

Looking beyond my family’s experience and the Oligo community, there are 30 million Americans who have a rare disease. That’s roughly 10% of the country. California’s population is 40 million, meaning that four million people in our state alone have a rare disease. Covered California insurance covers 1.8 million people in our state, so roughly 180,000 of these people would have a rare disease…and potentially be prevented from accessing medical care and clinical trials outside of CA.

If you have insurance coverage through a state exchange or the Federal exchange, I would strongly recommend that you contact your carrier and confirm that your plan provides the same coverage outside of your state as it does in your state. You may not need the outside expertise or clinical trials now, but if you have an Oligo the chances that you will are very high.

It would also be great to hear from you what you find out about the coverage being offered by your state insurance exchange. Depending on what is happening in other states, I think this could be an issue that gets media coverage or even congressional action. This is more than an insurance or bureaucratic issue. For some patients, it can be a matter of life and death.

My email is: [email protected]

-Brock Greene

Oligo Nation Founder